This was first written in answer to a question on Quora. The question was:

How might a currency be designed that helps build the commons?

I am putting my answer in an article here on the blog, after it was previously put in a note on fb, to preserve it and make the information available. Here is what I wrote…

If a currency could eliminate or at least attenuate the profit motive, which seems to drive most if not all economic activity today at the expense of the commons …

If that currency could lessen or even eliminate poverty, which can also act as a driver for activities that endanger the commons…

it might remove some of the pressure that is put on the commons for the purely economic reasons that grow out of greed and necessity…

but to actually build up the commons, active intervention might be needed.

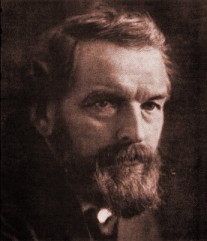

That brings me to the proposals Silvio Gesell made in “Die Natürliche Wirtschaftsordnung” (The NATURAL ECONOMIC ORDER) almost a century ago.

Silvio Gesell

We must realize that this book needs to be read with some patience, first because of the less-than-optimal translation that is available on the net and then because of the time that has passed since the book was written. Completed and first published in 1916, the work is a product of its time and back then, times were different from what they are today. Many of the conditions and events made reference to would be difficult, to understand. So reading Gesell’s book would also imply translating the concepts Gesell expressed into a modern day setting.

I will attempt to give a short overview of what Gesell envisioned in his monetary and social reform proposal, and how it could help build up the commons in a rather effective way.

Gesell’s proposals in The Natural Economic Order consist of two major parts that cannot stand on their own. “Freigeld” (Free Money) and “Freiland” (Free Land).

Gesell identified two major obstacles to economic justice at the time. Interest and Rent. Interest is of course the charge levied on money to induce it to circulate. Rent is a similar levy on land and real property. The owner excludes others from using money or property unless given compensation. Both interest and rent act to further concentrate economic power in the hands of those who already own large quantities of money or who in some way managed to ‘corner the market’ on usable land.

Free Money

Free Money was the idea of bringing the proceeds of interest into the commons by demurrage, a periodic charge on money of about the same rate as the basic interest rate, which is about 4 to 5 % per annum. Demurrage would take the place of interest, but instead of the proceeds accruing to individuals who possessed money, it would be available to the monetary issue authority, representing a kind of ‘monetary commons’.

To do something like this today, the power of money creation would have to be moved from the banks to either the treasury or, better yet, to a specifically designated monetary issue authority. That authority would be charged with keeping the exchange value of money stable by fine tuning the money supply. It could do that because of its power to either issue more money or halt or reduce the issue of money, in which case demurrage would decrease the money supply. The issue authority would be chartered to keep prices stable by closely watching a price index based on a representative basket of goods and by increasing or decreasing the supply of money.

Money is said to inflate (each unit loses value or purchasing power) when too much of it is in circulation in relation to goods-on-offer and it deflates (each unit gains value) in case there is too little money to mediate the circulation of goods and services on offer. An expanding economy would require more money to be issued, while a stagnating economy would need a diminishing money supply, to keep money’s value stable.

Velocity of circulation plays an important in this equation. Slow circulation has the same effect as too little money, while copious spending mimicks a larger money supply.

Therefore, fine tuning of the money supply can only work if there is an efficient mechanism to ensure money circulates. That mechanism, in Gesell’s proposal is the demurrage charged on all outstanding money. If I know money will be worth less in the future as it is subject to demurrage, I will spend today rather than tomorrow, which means there is a constant pressure for money to circulate.

Interest is not forbidden in Gesell’s world, but it would naturally tend to zero, as there is no reason for people to withhold money from circulation unless they are promised a premium, which is what interest is.

Gesell’s “rusting money”, as he also called it, would allow for sufficient abundance to promote all economic activity, while guarding against the “too much” that leads to inflation. It would also allow for spending money into circulation.

Gesell’s proposal was for this spending to be done by the State and if government had a constant stream of money to spend, coming from demurrage, taxes needed to support government spending could be reduced or eliminated.

So we would have a ‘tax on money’ to make taxing income and consumption (Value Added Tax or Turnover Tax) superfluous. Tax collection would be rather easy, as demurrage is an automatism built into the design of money itself, potentially putting a large part of the tax collection bureaucracy out of work.

Free Land

As Gesell’s reasoning went, those who would demand interest on money could be prevented from doing so with Free Money, but they would immediately move into real estate to continue to extract profits there by renting to the have-nots. Which brings us to the second part of Gesell’s proposal.

Land, Gesell said, should not be private property. It could be privately used, the resources could be privately exploited and any buildings in cities to be rented out would be private property, but since land is a finite resource, it should be treated as common (local community) property.

This would require bringing ownership of land into the communities that occupy it. The way to do this, according to Gesell, was to gradually let communities acquire their land from the former private owners.

A land tax should be established that would make it unprofitable to hold on to large land holdings that were not productive. Any time land was sold, the community should then have the first right to buy and piece by piece, the community would become the owner of all the land in its area

Early in the work, Gesell said private owners should be expropriated – against a fair price, to be paid in interest bearing state obligations.

Land so acquired would be leased to private persons or cooperatives or organizations through public auction. There would be long leases – 50, 70 or 99 years I believe are mentioned – to guarantee stability for the private use of land and resources, and as the community was the owner, it could set conditions of use that would, apart from the price of the lease, also set parameters for ecological use that would preserve the value of the land resource for future generations.

Raw materials could be privately exploited, but always subject to certain conditions as desired by the community and to freely established fair prices. Or in alternative, raw materials would be mined privately and then sold by the state.

The proceeds from leasing community land should be used, according to Gesell, to guarantee a basic family income, to be paid to all mothers residing in the community. The reason he gave for this was that the mothers, far from being unproductive, were actually raising the future generation and should be rewarded for that.

Those were what I remember of Gesell’s proposals – succinctly summarized – of how money and land could be used to build a strong commons.

If those proposals seem utopian today, they must have been more so at the time they were made, almost a hundred years ago and indeed, no country has so far adopted them.

Gesell’s proposals, both on money and on land ownership, would certainly strengthen the commons rather than big finance and private land owners.

– – –

If you like this particular rabbit hole, there is also a more recent and very interesting discussion on facebook, that arose around an article asking much the same question…

the article, by Matthew Slater, is titled

The conflict at the heart of modern money

and the facebook discussion that evolved out of it can be found here

“Making money into a positive force for social change requires detaching it from its role in storing value.”